Self employed 401k calculator

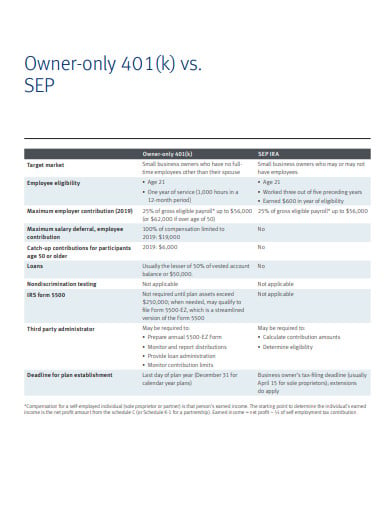

A Solo 401k plan is a 401k plan for self-employed business owners with no other full-time employees other than the owner and co-owner or spouse if applicable. Okay if youre self-employed and dont have any employees a one-participant 401kalso known as a solo 401kmay be right up your alley.

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Ryan a self-employed business owner participates in a Solo 401k that allows for Roth and regular non-Roth Solo 401k contributions.

. What is a spousal IRA. The lack of an employer-sponsored retirement plan like a 401k. Career The 42 Best Self-Employed Jobs in 2022.

This also means you dont have deductible benefits such as healthcare 401k or other financial costs and taxes are not taken from your take home pay. The Ohio State Tax Calculator OHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year. Financial Planning for the Self-Employed How the self-employed can create a sound financial plan and save for retirement.

This year Ryan makes 60000 and defers 10000 of his self-employment earnings to his non-Roth Solo 401k account. The Solo 401k is a retirement account and is tax-deferred therefore there is no tax return due for a Solo 401k plan. The perks of self-employment are plenty but theres at least one significant drawback.

Use this calculator to help you determine the impact of changing your payroll deductions. Each option has distinct features and amounts that can be contributed to the plan each year. Solo 401k plans also allow you to make.

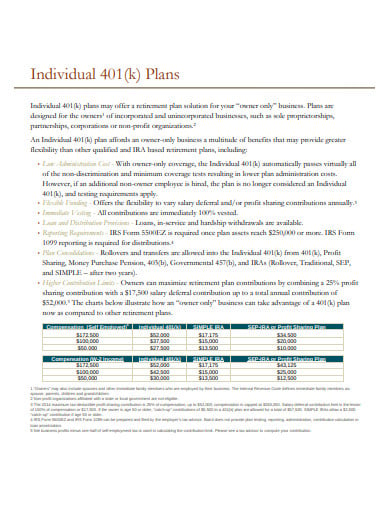

Use our free calculator to help you plan for retirement. These plans can be called Self-Directed 401k Individual 401k Individual Roth 401k Self-Employed 401k Personal 401k or One-Participant 401k depending upon the vendor offering the plan services. Elective deferrals up to 100 of compensation earned income in the case of a self-employed individual up to the annual contribution limit.

Financial Planning 18 Passive Income Ideas To Boost Your Earnings in 2022. Contributions are tax-deductible and you can contribute up to 20500 in 2022 or 27000 if youre age 50 or older. The calculator took one of these for you known as the self employment deduction.

For the self-employed the options are a bit more limited but there are still several retirement accounts you can choose from. As a self-employed individual your take-home pay will be in most cases significantly higher than if you were working for someone else. SD 401k sometimes called a solo 401k is a way for self-employed individuals to participate in a 401k plan.

Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. 25 of compensation as defined by the plan or. Traditional 401ks allow pre-tax contributions taxable withdrawals.

The most common four are. A Solo 401k plan a SEP IRA a SIMPLE IRA or a Profit. A Roth 401k is an account funded with after-tax contributions.

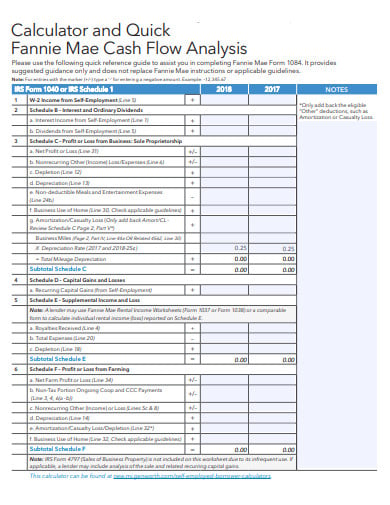

Retirement plan contributions are often calculated based on participant compensation. Find out how much you can contribute to your Solo 401k with our free contribution calculator. S Corp 401k.

Gross 401K Withholding Gross IRA Deductions Withholdings. You can quickly estimate your Ohio State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Ohio and. Employers offer 403b and 401k plans to help their employees save for retirement but chances are you wont have to choose between them.

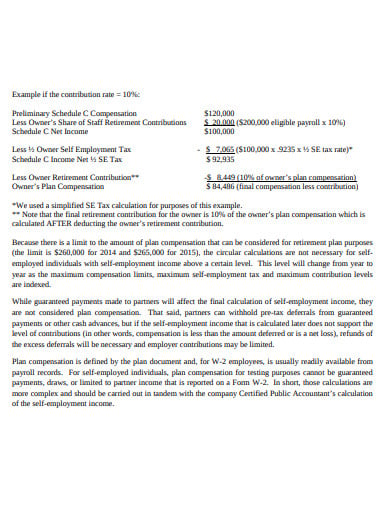

If you have less than 250000 in your 401k plan nothing needs to be filed. Although their purpose is aimed specifically at the self-employed SD 401k. For example you might decide to contribute 10 of each participants.

Enter the solo 401k or what the IRS. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Finance Tips for the Self-Employed.

Once you have 250000 or more in total plan value add up all your assets and cash in the plan you will file form 5500-EZ. Once you have established your Self-Employed 401k Plan and any new accounts the next step is to contribute to your 401k. 401k Employer Match Calculator Many employees are not taking full advantage of their employers matching contributions.

As of 2020 the 401k contribution limit for those aged 50 and below is 19500. An Individual 401k plan a SEP IRA a SIMPLE IRA or a Profit Sharing plan. Best retirement plans for self-employed.

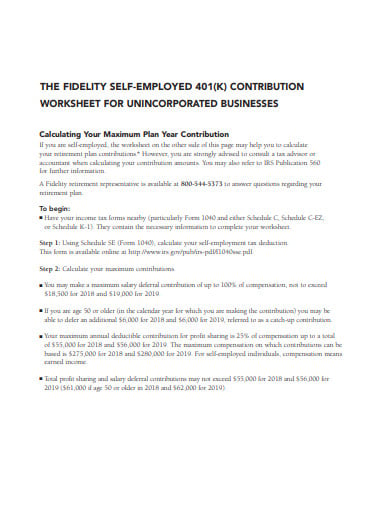

Learn how to start a self-employed 401k plan with Fidelity by following these step-by-step instructions or call us at 800-544-5373 for guidance throughout the entire process. Important Plan Provision Changes. If you are self-employed a sole proprietor or a working partner in a partnership or limited liability company you must use a special rule to calculate retirement plan contributions for yourself.

Some employers even offer contribution matching. Employer nonelective contributions up to. IRA and 401K Calculator.

Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Contribute to your 401k. This is also known as a Solo 401k and its perfect for self-employed individuals or business owners with no employees.

If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit or 27000. Adjusted Gross Income AGI is your net income minus above the line deductions. Rent Budget Calculator Play Pause Loading 0044 Open Share Drawer Facebook Twitter LinkedIn Real Minter Story.

529 Savings Plan Overview 529 State Tax Calculator Learning Quest 529 Plan Education Savings Account Custodial Account Overview. Save on taxes and build for a bigger retirment. Because your Social Security and Medicare tax bill is based on your Adjusted Gross Income you want to take as many deductions as you can to reduce it.

20500 in 2022 19500 in 2020 and 2021 or 27000 in 2022 26000 in 2020 and 2021 if age 50 or over. To calculate your annual retirement contribution based on your income you can use a Solo 401k calculator. Everything You Need to Know.

These two tax-advantaged retirement plans are designed. The 529 Plan Contributions allows tax deductions in certain states currently the Tax Form Calculator only applies this tax credit in Indiana please contact us if your State provides 529 Plan Contributions tax credits and we will integrate it into this tool. For self-employed people a solo 401k may offer greater annual contribution limits and bigger tax deductions than a SEP IRA depending on your income.

Jenny Play Pause Loading 0059 Open Share Drawer. New plan loan provisions are no longer offered in the TD Ameritrade Individual 401k plan. The contribution limit for 2022 is 20500.

Try to meet or exceed their matching amount to make the most of your retirement savings. If your employer offers a 401k plan consider contributing pre-tax money with every paycheck. Rollover IRA401K Rollover Options Combining 401Ks.

2022 Self-Employed Tax Calculator for 2023.

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Solo 401k Contribution Calculator Solo 401k

Solo 401k Rules For Your Self Employed Retirement Plan

Understanding Solo 401 K After Tax Total Additions Limit For Sole Proprietorship Bogleheads Org

How Much Can I Contribute To My Self Employed 401k Plan

How Much Can I Contribute To My Self Employed 401k Plan

How Much Can I Contribute To My Self Employed 401k Plan

Top 3 Retirement Plans For The Self Employed 401k Calculator

Solo 401k Contribution Limits And Types

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Here S How To Calculate Solo 401 K Contribution Limits

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

2